Opinion Piece

Private & foreign banks only own 2% of China’s domestic banking assets. The scale and scope of credit control by the CPC, shouldn’t be underestimated, with the vast majority of banks operating under the Party’s control.

In terms of banking profits, 87% of profits generated by China’s banks were funneled back into the “real economy”, a big portion in the form of dividends was distributed to state-owned entities, which acted as fiscal spending/investment in the real economy. Another to citizens via stock. Retained capital indirectly supports the real sector by leveraging credit and bond purchases to the real sector again [1]

The retail banking industry in China has some of the largest publicly listed banks in the world co-existing with hundreds of thousands of less-regulated rural co-operative institutions. The present Chinese banking industry is regulated by the “Big Four”: the Industrial and Commercial Bank of China (ICBC), People’s Bank of China (PBC), China Construction Bank (CCB), and Agricultural Bank of China (ABC). All four of the “Big Four” are state-owned lenders. [2]

There are four main kinds of banking institutions in China: Market oriented banks, policy-oriented banks, city commercial banks, and rural financial institutions, all of whom are state owned or controlled.

Market oriented banks refer to the state owned commercial banks that dominate China’s banking landscape, but are still listed on the stock market. They include the aforementioned “Big four” banks. State owned commercial banks are much larger in size and operation, usually being run by the provincial or central government.

Policy-oriented banks are designed to help the government achieve its long-term goals in areas where profit-driven banks might be reluctant to lend. The government can also use them to raise investment or boost economic spending to prevent a financial collapse/slump. An example being in 2014, the China Development Bank was used to prop up the economy due to a stock market downturn, which stabilized the economy and fueled shantytown renovation. Major examples of policy banks include the China Development Bank (CDB), Export-Import Bank of China (Eximbank) and the Agricultural Development Bank of China (ADBC).

The CDB is used for Infrastructure, urbanization, industry upgrade and equipment manufacturing, poverty relief and development. Eximbank is used for foreign trade and cross-border investment, “Belt and Road” infrastructure projects abroad, helping small- and medium-sized companies “go global”. The ADBC is used to finance the building of reserves of key agricultural products, rural infrastructure, shantytown redevelopment, and agricultural firms.

City commercial banks are overwhelmingly majority owned by the local government, though private and foreign shareholders can exist as minority shareholders. The majority of rural banking institutions are rural credit cooperatives, operated by rural/farmer cooperatives to provide credit to other agricultural cooperative groups. Overall, all bank managers are appointed by the CPC, with commercial banks subject to credit quotas and ultimately, all the main kinds of banks are subject to control from the Chinese state council, either through the local or central government. [3]

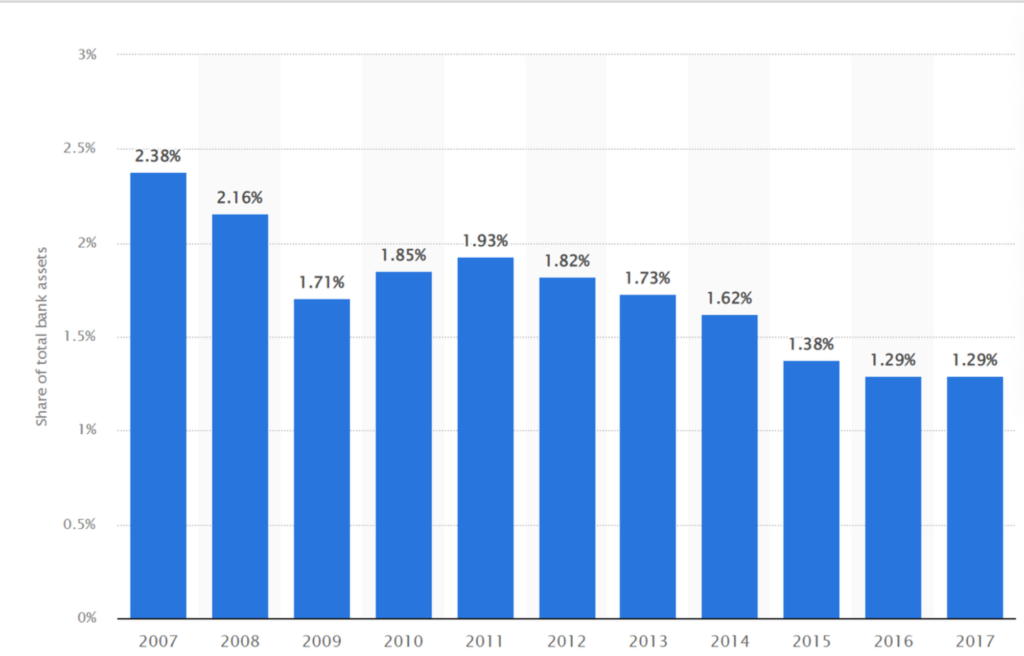

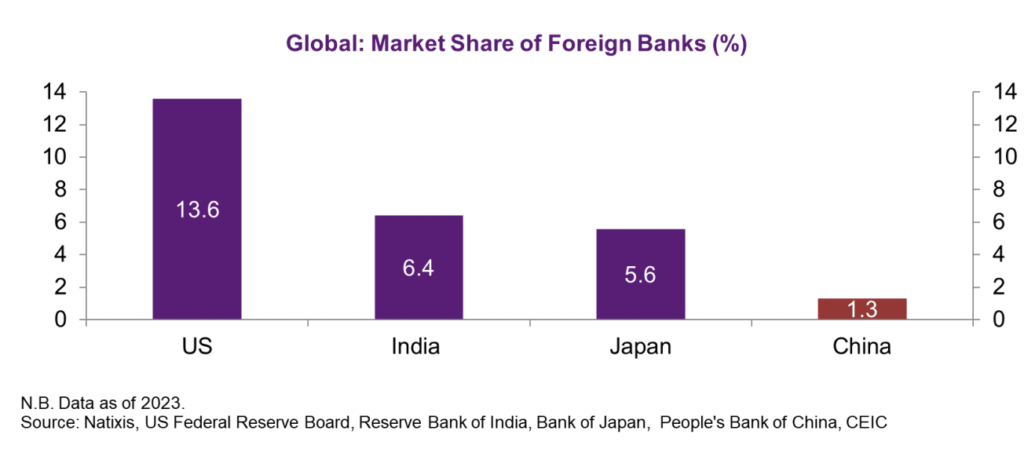

Let’s take a look at solely private banks, of which in China there are only 19. The total assets of private banks as of 2024 are 2 trillion RMB, out of the total of around 400 trillion in the entire banking industry. This means private banks only have a 0.5% share of total banking assets! [4] But what about foreign banks, how much control do they have? By 2017, foreign-owned banks operating in China only held 1.3% of the total banking assets. Available data from 2021 claims that it held only 1.4% (3.79 trillion RMB) of said banking assets, meaning that from 2017 – 2021, the growth of foreign owned banks have been stagnant [5]. And in 2023, the market share of foreign banks in China only account for 1.3%

Image source: Statista.com

Image Source: Linkedin.com

Source:

1) 银行利润去哪了?──银行业专题报告

2) Chinese state-owned commercial banks in reform: inefficient and yet credible and functional?

3) China’s Financial System: the Tension between State and Market

4) 民营银行十年:总资产近2万亿,5家资产超千亿,需直面多项挑战

5) 截至2021年末外资银行在华资产总额3.79万亿元